🌇 SEE THE SPACE | STS Office – Trusted Office Leasing Agency in Ho Chi Minh City

STS Office is proud to be one of Ho Chi Minh City’s leading office leasing and consulting agencies, committed to delivering free advisory services, transparent information, and the best rental negotiations within 24 hours.

With deep market experience, STS Office is pleased to introduce the report:

“Ho Chi Minh City Office Market Trends 2025–2026: Competition, Transformation & Investment Opportunities” — a comprehensive overview to help businesses stay informed on rental price movements, vacancy rates, and new trends, supporting their office planning, expansion, or restructuring with maximum efficiency.

Table of Contents

- Overview of Ho Chi Minh City’s Office Leasing Market

- Key Market Trends 2025–2026

- Forecast 2025–2026 for the HCMC Office Market

- Recommendations for Businesses and Tenants

- Conclusion

1. Market Overview – Ho Chi Minh City Office Leasing

1.1 Current Scale

The Ho Chi Minh City office market is in a recovery phase following the pandemic, shaped by the rise of hybrid work models and corporate relocations.

- Total office stock: ~1,639,226 m²

- Occupancy rate (Grade A & B): 88–90% in early 2025

- Average Grade A rent (CBD): ~USD 55/m²/month (Q1 2025)

1.2 Market Conditions and Drivers

HCMC remains Vietnam’s commercial hub, attracting strong foreign direct investment (FDI) from IT, finance, manufacturing, and logistics sectors — the main demand sources for quality office space.

The hybrid work model (office + remote) has become the new normal, reshaping leasing decisions — space size, layout, and amenities.

Urban infrastructure upgrades in Thu Thiem, Phu My Hung, and East HCMC are creating new office hubs beyond District 1 & 3. Many upcoming Grade A buildings will cluster in these emerging zones (2025–2027).

1.3 Supply & Demand

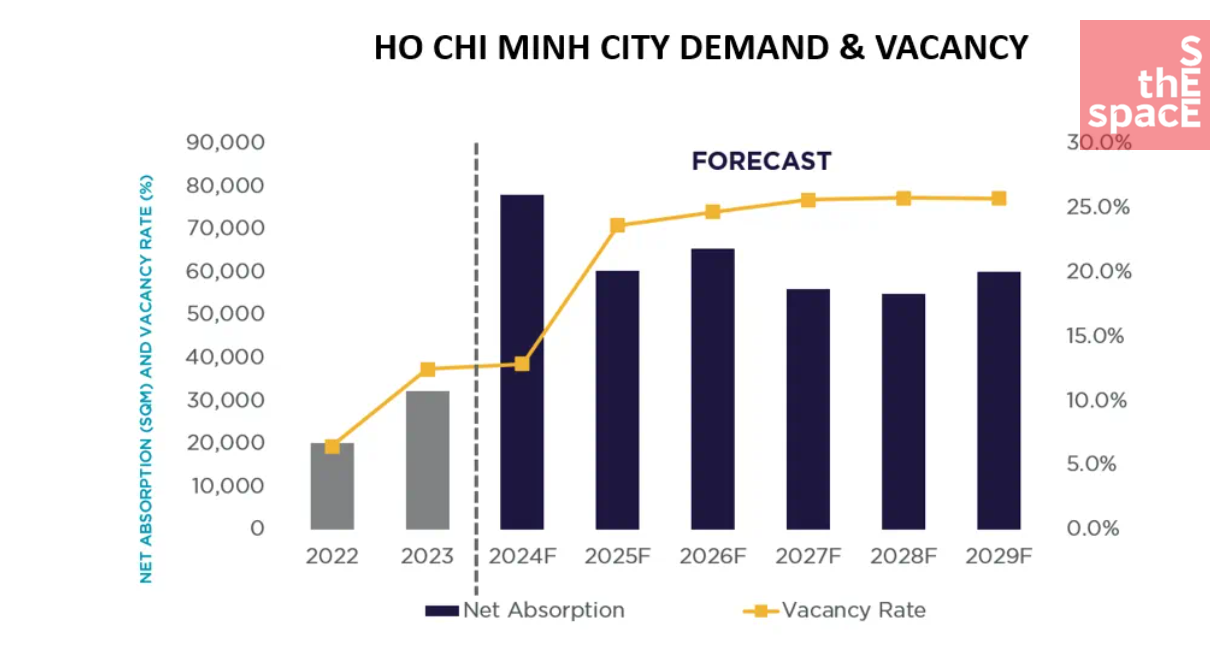

- Supply: ~165,000 m² of new office space expected in 2025.

- Demand: Steady but slower absorption (~50,000 m² in 2025) as operating costs rise and hybrid work reduces space needs.

- Vacancy: Expected to climb above 24% in 2025, especially outside the CBD.

2. Key Market Trends 2025–2026

2.1 Shifting Locations and Segments

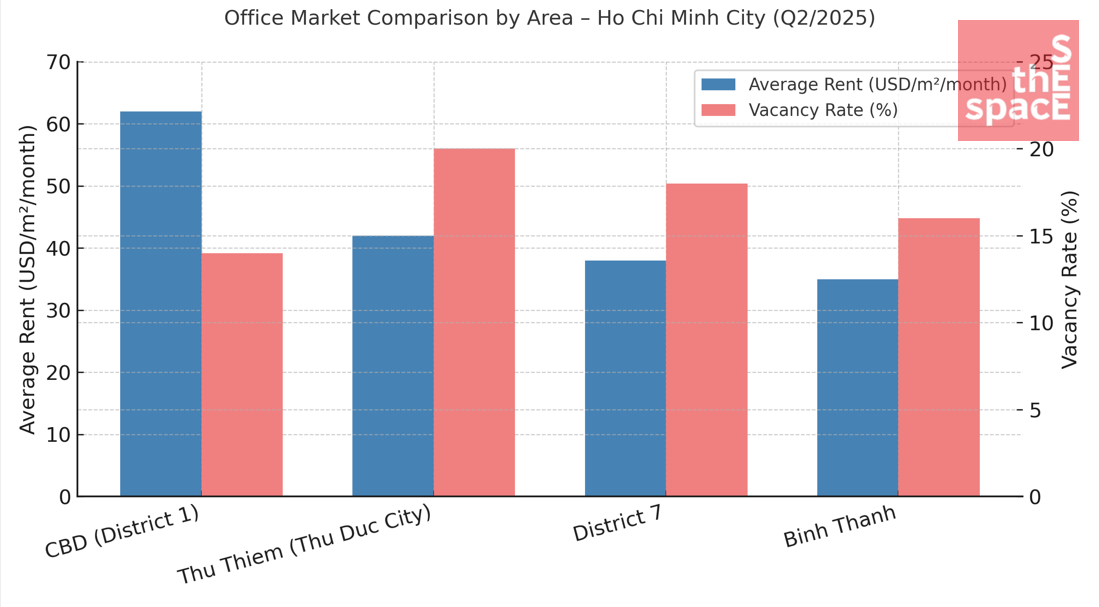

Tenants are moving from the CBD (District 1 & 3) to fringe areas like Thu Thiem (Thu Duc City) and Phu My Hung (District 7) for lower costs and better infrastructure.

Developers are expanding in the East and South — transforming industrial areas into new Grade A/B office clusters.

This creates a clear segmentation: premium CBD Grade A buildings vs. competitive, high-quality suburban offices.

2.2 “Flight to Quality” – Green & International Standards

Multinational tenants increasingly seek LEED-certified, green, smart buildings with modern amenities. Nearly all new projects since 2019 in HCMC meet green standards.

Owners with certified, energy-efficient buildings can command higher rents, while older properties face competitive pressure.

The “flight to quality” trend shows tenants willing to pay more for better workspaces to enhance brand image and employee retention.

2.3 Flexible & Hybrid Workspaces

Hybrid work reshapes demand: companies lease smaller but more adaptable spaces — co-working, serviced, or flexible offices.

Building owners and operators are integrating flex space within traditional leases (“pay-as-you-grow”) to accommodate shifting headcounts.

2.4 Supply Pressure and Pricing Strategies

With ~165,000 m² of new space entering in 2025 and ~85,000 m²/year afterward, competition intensifies.

- 2025: Rents may rise ≈ 5% due to prime Grade A launches.

- 2026 → : Growth slows to ~ 0.4–0.5% annually amid higher vacancy.

Landlords will offer rent-free periods, fit-out support, and flexible terms to attract tenants.

2.5 Core Industries & International Tenants

Leading demand drivers: IT, fintech, banking, manufacturing, logistics.

The IT/telecom sector alone represents ~ 30% of new leases in HCMC.

Foreign tenants — particularly from Japan, Korea, and the U.S. — continue expanding, strengthening premium demand.

2.6 New Growth Areas

Thu Thiem (Thu Duc) and District 7 (Phu My Hung) are emerging as secondary office hubs with modern infrastructure and lower costs.

Grade B/C offices gain traction among SMEs and new foreign entrants, balancing cost and convenience.

The sub-CBD model is increasingly favored for its flexibility and traffic relief.

2.7 Technology, ESG & Sustainable Operations

Next-gen office buildings integrate IoT systems, smart HVAC, energy-efficient lighting, and security management.

ESG compliance (Environmental, Social, Governance) is now a key selection criterion for global occupiers.

Older, non-compliant buildings risk losing tenants to newer developments.

2.8 Lease Flexibility

To compete, landlords now offer shorter leases, rent-free periods, and flexible clauses (e.g., adjustable floor space).

Co-working and serviced offices continue expanding as viable options for startups and representative offices.

3. Forecast 2025–2026

3.1 Supply & Demand Outlook

- New supply 2025: ≈ 165,000 m²

- Annual new supply 2026+: ≈ 85,000 m²

- Net absorption 2025: ≈ 50,000 m²

- Vacancy: > 24% by 2025

3.2 Rental Forecast

- 2025: +5% (supported by new CBD Grade A launches)

- 2026+: Minimal growth (0.4–0.5%/year) due to rising competition

3.3 Growing Segments

- CBD Grade A: stable but higher vacancy risk

- Grade B/suburban: stronger growth potential

- Thu Thiem & Phu My Hung: key expansion zones

- Flexible offices: growing mainstream model

3.4 Key Risks

- Economic slowdown or higher operational costs

- Oversupply exceeding absorption capacity

- Infrastructure delays outside CBD

- ESG and technology compliance gaps

4. Recommendations for Tenants

- Assess location, accessibility, amenities, cost, and building quality carefully.

- For hybrid models, consider flexible or serviced offices to optimize space and cost.

- Leverage market competition to negotiate rent-free periods and fit-out incentives.

- International companies should prioritize green-certified, high-standard buildings to align with global ESG policies and talent goals.

5. Conclusion

The HCMC office market (2025–2026) stands at a turning point.

With rising supply, evolving tenant expectations, and a shift toward sustainability and flexibility, the market is entering a phase of intense competition and strategic adaptation.

- 2025: rents may edge up ≈ 5%.

- From 2026 onward: growth stabilizes (0.4–0.5% annually), with tenants focusing on value and efficiency.

Landlords who embrace ESG, technology, and flexible leasing will stay competitive, while businesses that adapt early will gain the best opportunities.

STS Office – Your Trusted Leasing Partner

STS Office is always ready to help you find the most suitable workspace at the best rental terms, backed by professional and dedicated service.

📞 Hotline: +84 768 999 647

📧 Email: leasing@seethespace.vn

🌐 Website: seethespace.vn